Body

How we work with our clients

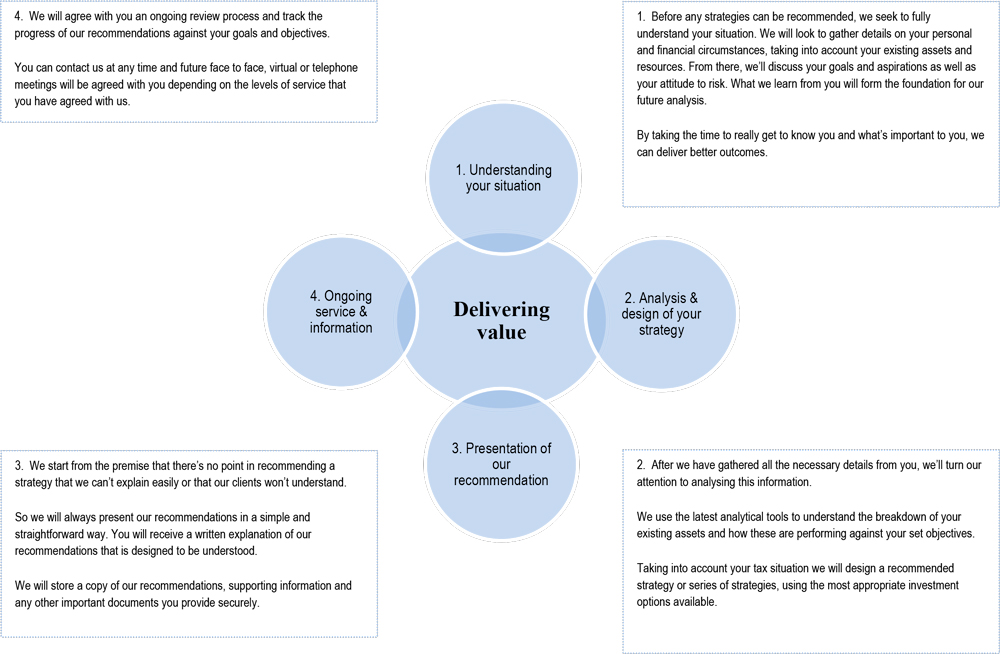

Our advice and recommendations are tailored to your needs and circumstances and in this way we deliver value to you.

We never forget that it is your financial plan – your future.

We provide different services for clients with varying requirements, but the following information is, in the main, relevant to the process and benefits we provide for everyone.

The service we can offer is broken down into six stages:

- Initial Consultation

- Review Process

- Research Process

- Recommendations

- Implementation

- Ongoing Service

1. Initial consultation – we offer this at our own expense. The purpose of this is to identify and understand your personal needs and objectives, establish what benefits would result from using our services, outline the associated costs and provide you with the opportunity to appoint us.

2. Review Process - this could be specifically related to particular issues you feel require attention or encompass a complete overview of your entire financial situation. It could include a review of: existing investments and cash deposits; pensions and retirement planning; life or health protection; Inheritance Tax and estate planning; lifestyle planning.

3. Research Process - using the results of our review process we then carry out research to enable us to identify the most suitable recommendations to help you to achieve your personal financial needs & objectives.

4. Recommendations - we present to you our report detailing the results of our research and a recommended strategy, including specific investment and financial products that will support you in achieving your personal goals and aims.

5. Implementation - this process only begins once you have decided that you wish to embark on the strategy recommended and have instructed us to put this in place. This may involve arranging investments or products on your behalf or simply implementing a specific financial planning process, such as estate planning.

6. Ongoing Service - dependent upon your circumstances the ongoing relationship may vary but generally the purpose of this is to monitor your ongoing position to ensure that the strategy continues to meet your requirements.

Flexible and bespoke

All of the above is tailored to your specific needs and this is most obviously seen with regards to our Ongoing Service. For instance, if you would simply like to receive advice and recommendations at a single point in time, and no continuous assistance, we can easily accommodate that approach.

An ongoing relationship with clients has always been integral to our approach, however, as we believe that it can add significant value to both individuals and businesses. It takes into account changing circumstances and objectives, as well as developments in economic conditions or legislation (e.g. taxation). It also provides the opportunity for you to consider and access new ideas and financial products.

In this way, progress towards your objectives can be more regularly and effectively monitored.

Your financial plan

A financial plan is a little like a travel plan – it identifies where you are starting from, where you are going to, how and when you’ll get there, how much it will cost, and things to do along the way.

Similarly to planning a trip, your financial plan can be highly detailed or general in nature dependent on your individual needs.

Either way it is highly important - having no plan at all could leave you stranded.

Your financial plan will most likely address one, a few, or all of the areas in the diagram, and we can assist you with all of the relevant aspects.

The key benefits of working with us

There are many advantages to receiving advice from Warwick Road Financial Services the key of which are:

- We help you control your finances – whether you require 24/7 online access to your own, personal financial strategies or simply want an expert to help you plan for present risks or future needs, we are here to help.

- Our expertise can help meet your goals – by analysing your appetite for risk we can assist you in ensuring that your goals are realistic increasing the probability of them being achieved.

- We assist you in focusing on your needs – surveys show that advice from financial advisers ensures that people are generally far better protected against the unknown and more comfortable in retirement.

At all times we work closely with our clients, keeping them well informed and explaining matters in a clear and understandable manner.

Harnessing Technology

Our state-of-the-art back office systems ensure that we can provide a highly efficient, streamlined service to all of our clients.

Access to a range of providers and their platform systems can provide 24/7 online access to all of a client’s relevant financial matters where this is desired.

Our ability to utilise numerous industry tools to analyse and address financial products and investment opportunities ensures that we are up-to-date and knowledgeable when assisting and advising clients.

How and what do we charge?

Many advisory companies offer a tiered service – effectively a gold, silver and bronze approach. We feel that, by definition, this infers that some clients therefore receive an inferior service – and this is entirely contrary to our philosophy.

We provide a high quality, premier service to all of our clients.

In addition, we realise that each individual is different, as are their circumstances and needs – and want to only receive, and pay for, services and expertise that is relevant to them. Therefore, with each individual client we agree to provide only the services required and from which they can benefit – and only to charge for those specific services.

This creates an arguably unique approach, where each client has a bespoke approach to both their planning and the costs of this specialist advice.

What to do now?

Warwick Road Financial Services can provide you with a superior and friendly service – always placing you first, treating you as we would like to be treated.

If you would like to find out more about our services and philosophy or to arrange a complimentary, no-obligation meeting, please contact us.

Warning Text

TAX TREATMENT VARIES ACCORDING TO INDIVIDUAL CIRCUMSTANCES AND IS SUBJECT TO CHANGE.

THE FINANCIAL CONDUCT AUTHORITY DOES NOT REGULATE ADVICE ON ESTATE PLANNING AND TAX PLANNING.

THE VALUE OF INVESTMENTS AND THE INCOME THEY PRODUCE CAN FALL AS WELL AS RISE. YOU MAY GET BACK LESS THAN YOU INVESTED.